After talking to dozens of oldsters, a principal a few instances, and a monetary support officer, I’ve decided the most important monetary false impression about making use of to varsity is that it’s important to be poor or center class to obtain monetary support. The suggestions I’ve obtained from everyone is that you would be able to earn a multiple-six determine earnings and nonetheless obtain free cash for faculty.

For proof not based mostly on my conversations, MIT introduced on November 20, 2024,

“Undergraduates with household earnings under $200,000 can anticipate to attend MIT tuition-free beginning subsequent fall, due to newly expanded monetary support. Eighty % of American households meet this earnings threshold.

As for the 50 % of American households with earnings under $100,000, dad and mom can anticipate to pay nothing in any respect towards the full value of their college students’ MIT training, which incorporates tuition in addition to housing, eating, charges, and an allowance for books and private bills.

This $100,000 threshold is up from $75,000 this yr, whereas subsequent yr’s $200,000 threshold for tuition-free attendance will enhance from its present degree of $140,000.â€

$200,000 Is Now Thought of “Poor Sufficient†for Free Monetary Assist

A family earnings of $200,000 is undoubtedly substantial in comparison with the U.S. median family earnings of about $80,000. Households incomes this a lot can typically keep a snug middle-class life-style, particularly in non-coastal cities.

Nevertheless, in cities with a excessive value of dwelling and a number of kids, $200,000 doesn’t stretch so far as one may anticipate. This monetary pressure is more and more acknowledged by elite schools like MIT, which now supply tuition-free attendance for households incomes below $200,000. Different establishments could quickly observe go well with.

The pure query then arises: how a lot over $200,000 are you able to earn and nonetheless qualify for support? Surprisingly, the reply is rather more than anticipated.

To make clear, once I discuss with free monetary support, I imply grants and scholarships—free cash for faculty—not loans. Anybody can take out a mortgage.

My Dentist’s Daughter Receives Grants

Throughout a routine enamel cleansing, my dentist shared an sudden perception about monetary support. Her daughter obtained $20,000 yearly in grants to assist cowl her $38,000 non-public highschool tuition for 4 years, regardless of their excessive earnings.

My dentist probably earns not less than $200,000, and her husband, who works in tech, probably earns the same quantity. Even with a mixed earnings of $400,000 or extra, they certified for support.

Her daughter now attends the College of Southern California (USC), the place tuition for the 2025 college yr is $69,904, with whole annual prices estimated at $95,225. Fortunately, the household nonetheless receives monetary support. Nevertheless, my dentist famous that rising dwelling fairness negatively impacted their means to safe further grants.

Maybe you even have this monetary false impression {that a} dentist and a tech employee are wealthy sufficient to pay 100% for personal college on their very own. With the common value of dental college to over $125,000 a yr in tuition at some locations, maybe the return will not be as excessive as one may assume.

A Couple Making Near $1 Million a Yr Receives Monetary Assist

Whereas taking part in pickleball, a dialog with a fellow participant took an fascinating flip. His children attend an costly non-public college in San Francisco with tuition prices of $59,000 per yr. He shared that his spouse’s greatest buddy, the varsity’s head of monetary support, revealed that households incomes as much as $500,000 per baby can nonetheless qualify for monetary support.

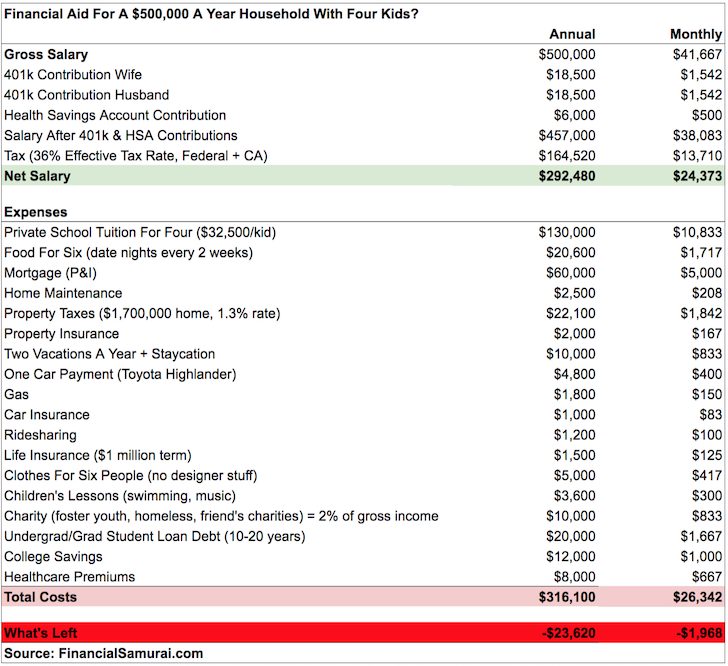

This revelation may appear surprising—incomes $500,000 per baby and receiving monetary support feels nearly surreal. Nevertheless, it aligns with prior insights I’ve explored, akin to in a put up profiling a household incomes $500,000 however with 4 kids. Their expense profile made them eligible without spending a dime tuition cash, regardless of their excessive earnings.

On this newest instance, my pickleball associate described a family the place the husband works in finance and the spouse works in tech, each holding upper-middle administration positions. Mixed, they earn near $1 million yearly, but they nonetheless obtain monetary support.

Making use of for monetary support with such a excessive earnings may appear audacious. However because the saying goes, in case you don’t ask, you don’t get. Their success underscores the significance of understanding how monetary support formulation keep in mind not simply earnings but additionally bills, household dimension, and different components.

Swallow Your Delight And Apply For Monetary Assist

In case you’ve been a long-time reader of Monetary Samurai, you could have adopted a mindset of attaining monetary independence with out counting on anybody however your self. This philosophy aligns with my new three-legged stool for retirement, which is centered on self-reliance. Right here’s why I’ve embraced this mindset.

Rising up in creating nations, I witnessed firsthand how a few of those that trusted authorities help remained trapped in poverty. In distinction, people who took dangers and pursued entrepreneurship typically turned profitable.

My private journey introduced me to America for highschool and faculty, the place navigating challenges as a minority additional ingrained my perception in self-reliance. Individuals naturally are biased to assist those that look extra like them. Due to this fact, you might be at a definite drawback when fewer folks along with your background are in management roles.

As soon as I began incomes, I turned accustomed to paying important taxes and unsubsidized bills. For instance, paying $2,500 month-to-month for healthcare helps subsidize others who can’t afford it. Equally, dwelling healthily helps scale back my affect on the healthcare system to release area for individuals who want extra assist. These habits foster a way of independence, which may make it tough to contemplate receiving help, even when eligible.

However watch out with adopting this philosophy of self-reliance so rigidly. Having an excessive amount of satisfaction could lead to a tougher life than needed.

The Vanity Of Believing That You Are Too Wealthy For Assist

One other “difficulty†with having the angle of solely counting on your self to construct wealth is that you just may truly succeed! When your again is in opposition to the wall, you are inclined to do the whole lot potential to outlive after which thrive.

After making sufficient cash and constructing sufficient wealth to really feel snug, and even financially unbiased, chances are you’ll arrogantly consider you are too wealthy to qualify for any support. I say “boastful†as a result of chances are you’ll mistakenly consider you might be wealthier than the overwhelming majority of your friends, when in actuality, there’s a fair richer subset of oldsters who’re far wealthier than you.

For instance, to illustrate you make a high 1% earnings of about $650,000 and have two children. You have acquired the flamboyant title with a dozen firm reviews. Most individuals would not dare to use for monetary support in such a circumstance. It could really feel too embarrassing.

Nevertheless, the truth is that there are dad and mom at your grade college and faculty who make 10X to 50X your quantity, or $6.5 million to $32.5 million yearly for years. They’re those donating the large bucks to assist subsidize different households.

To them, your $650,000 annual earnings is like pocket change. They and faculty monetary support officers would fortunately subsidize a few of your tuition if you’re a fantastic household who may match a demographic they’re particularly missing.

Closing Monetary False impression About Making use of To School

After studying this text, you may really feel tempted to sport the monetary support system. Nevertheless, I need to depart you with one last monetary false impression to contemplate when making use of for faculty or non-public grade college: the notion that poorer candidates mechanically have a better likelihood of getting in than wealthier ones.

Whereas there was a powerful and justified push towards socioeconomic range, this pattern doesn’t all the time translate right into a aggressive benefit for households of much less prosperous college students.

Whether or not non-profit or not, faculties function like companies that must generate sufficient income from tuition {dollars} and donations to fund operations. Due to this fact, if your loved ones has the means to pay full tuition, your loved ones could stand a greater likelihood of getting in. Faculties want full-tuition payers to assist subsidize non-full-tuition payers.

It is a comparable idea to the federal government counting on 60% of working Individuals to subsidize the 40% who don’t pay earnings taxes. The identical precept applies to healthcare, the place working Individuals incomes greater than 400% of the Federal Poverty Degree should pay full worth for medical insurance, whereas these incomes much less obtain subsidies.

Though faculties declare your funds do not matter when making use of, they typically do. They only cannot publicly say so out of worry of receiving an excessive amount of backlash.

Free Cash For School As A Excessive-Revenue Earner

So I say in case you’re making lower than $500,000 a yr per baby and have lower than $1.5 million in family belongings per grownup, it is value making use of for monetary support if you’d like an opportunity at free cash. The faculties may simply provide you with a reduction just because they need you. You by no means know.

As an instance the varsity is positioned in New York Metropolis. They may settle for one other household whose dad and mom work in funding banking, which represents one of many largest industries dad and mom hail from. Or, they may resolve to decide on a household whose mom is an completed artist. Though she’s incomes $600,000 a yr, the varsity may supply a 20% low cost within the type of support to entice the household to affix.

Associated: The Completely different Methods To Pay For School

Readers, have you ever heard of any case research the place high-income-earning households obtained monetary support? Are you a high-income-earning household making use of for monetary support? Do you assume it is morally OK to be incomes a high 10% earnings and nonetheless receiving free cash for college? What are another monetary misconceptions about making use of to varsity or non-public grade college that individuals ought to concentrate on?

Dialog With John Durante, Excessive Faculty Principal About Making use of To School

You’ll be able to study extra about John and his podcast and e book right here.

Plan To Pay For School Higher With Boldin

In case you’re critical about monetary planning to pay for faculty, take a look at Boldin. Boldin is without doubt one of the strongest monetary planning instruments I’ve come throughout that helps households save for faculty, purchase a home, plan for retirement, and extra. They provide a free model and a PlannerPlus model for simply $120/yr—much more inexpensive than hiring a monetary advisor.

Boldin takes a complete strategy to monetary administration. As a substitute of solely concentrating on inventory and bond investments, Boldin tackles a variety of real-life monetary eventualities all of us encounter. One of many greatest challenges households face at present is discovering one of the best ways to save lots of and pay for faculty with out jeopardizing their retirement plans.

Boldin is a proud affiliate associate of Monetary Samurai and I’m a consumer.

Subscribe To Monetary SamuraiÂ

Pay attention and subscribe to The Monetary Samurai podcast on Apple or Spotify. I interview consultants of their respective fields and focus on a few of the most fascinating matters on this website. Your shares, rankings, and evaluations are appreciated.

To expedite your journey to monetary freedom, be part of over 60,000 others and subscribe to the free Monetary Samurai e-newsletter. Monetary Samurai is among the many largest independently-owned private finance web sites, established in 2009. Every little thing is written based mostly on firsthand expertise.