Within the second half of 2023, I considerably impacted our passive earnings, inflicting our family to technically lose its monetary independence. Previous to this, we had been financially impartial since 2012, once I left my banking job.

My aim now could be to regain monetary independence by December 31, 2027. To realize this, I would like to revive the ~$150,000 in passive earnings we misplaced by promoting shares and bonds to purchase our new residence. This may convey our passive earnings again to ~$380,000, permitting us to keep away from needing to work.

Beginning in September 2024, our bills will enhance to roughly $280,000 a 12 months after taxes as our daughter attends an impartial Mandarin immersion faculty. Consequently, with an assumed 20% efficient tax fee, we require at the very least $350,000 a 12 months in gross passive earnings for monetary independence.

Though the problem of regaining monetary independence whereas elevating two children in an costly metropolis is daunting, I am excited for the journey. It is just like the thrill you’re feeling when planning earlier than occurring an ideal trip.

The Journey Again To Monetary Independence: Stage One

Step one in the direction of regaining monetary independence is to really feel financially safe once more. Essentially, feeling wealthy is vital given it transcends all ranges of wealth. There are individuals who make thousands and thousands a 12 months who really feel constrained, and individuals who make $50,000 a 12 months and have greater than sufficient.

I violated my 30/30/3 home-buying rule by not sustaining a ten% liquid money buffer after buy. Consequently, we felt financially insecure for six months. It was a mentally taxing time with heightened anxiousness and stress.

Nonetheless, partially because of a shock actual property capital distribution in early 2024, we have been in a position to pay our hefty property tax payments and meet a flood of surprising capital calls. Hooray for constant investing!

To additional increase liquidity, we have reduce down our meals, transportation, and leisure price range. For instance, I skipped a $500 dad’s night time out occasion to save cash, and we eradicated all pointless subscription bills.

Having $103,000 from the actual property capital distribution can generate $5,450 in passive earnings if invested in a one-year Treasury bond. Nonetheless, I made a decision to speculate $93,000 within the S&P 500, particular person tech shares, and in Fundrise’s enterprise product. When it is a bull market, it is vital to press to seize as a lot upside as potential.

The remaining $10,000 is incomes 5% in a Constancy cash market fund, sustaining liquidity for upcoming capital calls and any shock bills. All these actions have made us really feel extra financially safe.

The Journey Again To Monetary Independence: Stage Two

The second step towards regaining monetary independence was deciding whether or not to promote or lease out our previous residence.

Given my bullish outlook on the San Francisco actual property market because of the energy and upside in know-how and synthetic intelligence, I selected to lease out the property. Regardless of my reluctance to tackle one other landlord accountability, I imagine that is the best monetary resolution. Moreover, promoting throughout the winter is the worst time of the 12 months to promote.

I ended up renting out my previous residence for $9,000 a month beginning February 1, 2024. Though I aimed for $10,000 a month, I could not discover the perfect tenants in time. I may need discovered a single unit household in April, Could, or June, however I wasn’t keen to forgo an extra 2-4 months of lease.

Securing tenants introduced large monetary aid given our hefty mortgage. After mortgage and property taxes, we’ll web about $43,000 a 12 months. Any surprising bills will scale back this web determine.

Identical to with proudly owning the S&P 500, the greatest length to carry actual property is without end. Sadly, many people run out of endurance coping with tenants and upkeep points.

On reflection, if I bought within the spring of 2024, it might have been good timing, as a result of the bidding wars got here again with a vengeance.

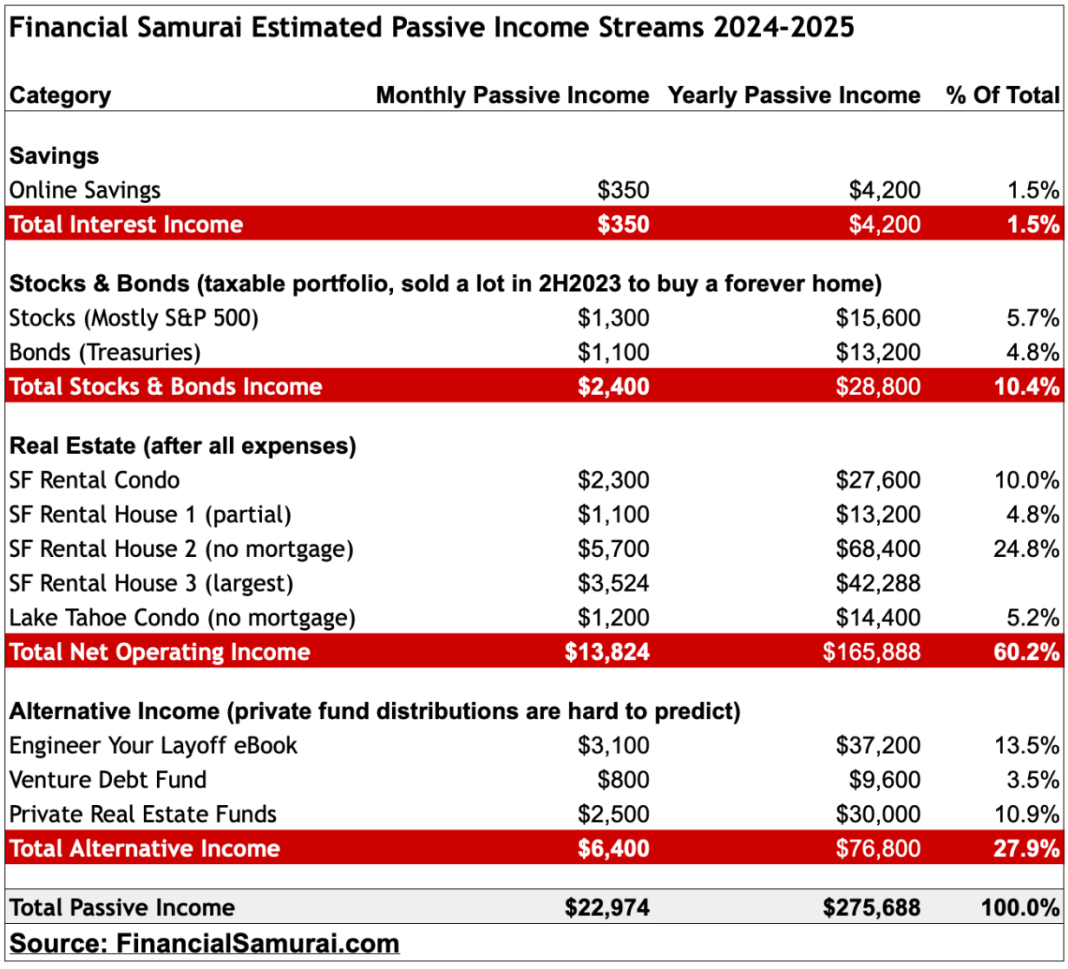

Newest Estimated Passive Earnings: $275,000

After finishing stage one and stage two of my grind again to monetary independence, our passive earnings has rebounded from $230,000 to ~$275,000. Based mostly on our present passive earnings, we’re nonetheless ~$75,000 in gross passive earnings in need of attaining monetary independence.

To generate this extra $75,000 in gross passive earnings, we would want to build up:

- $1,500,000 in capital at a 5% fee of return

- $1,875,000 in capital at a 4% fee of return

- $2,500,000 in capital at a 3% fee of return

With rates of interest at present excessive however anticipated to ultimately lower, concentrating on $1,875,000 in new capital by the tip of 2027 is the aim. Nonetheless, there’s only one huge downside: each my spouse and I haven’t got jobs!

The Closing Stage Of Getting Again To Monetary Independence

The ultimate stage to realize monetary independence is by far the toughest since a lot new capital is required. Right here’s how I might doubtlessly accumulate $1,875,000 by the tip of 2027.

1) Get a Job

One approach to accumulate $1,875,000 in new capital is to get a high-paying job in finance or tech. Nonetheless, discovering a $868,000+ a 12 months job and saving 100% after paying a 28% efficient tax fee is difficult, particularly if you have not had one since 2012. So, that unicorn job probably will not occur.

If my spouse and I do part-time consulting, we would be capable of earn $200,000 – $300,000 in lively earnings. This earnings would at the very least cowl the shortfall between our $275,000 in gross passive earnings and our $280,000 in upcoming after-tax bills. However it wouldn’t be sufficient to build up our goal capital quantity in three years.

2) Write One other Bestselling Ebook

As a result of Purchase This Not That turned a nationwide bestseller, I used to be provided a subsequent two-book deal by Portfolio Penguin. As soon as I finalize my second e-book for manufacturing this summer season, I’ll obtain my second installment of the e-book advance. As soon as the e-book is out in Spring 2025, I’ll get my third installment. One 12 months after the e-book launch, I will get my fourth and last installment. Then it is off to writing my third e-book.

After tallying up the hours I’ve spent writing and enhancing my second conventional e-book, I’ll make lower than minimal wage. That stated, I write for the enjoyment of writing, not for the cash. I’ll reinvest 100% of my e-book advance installments within the S&P 500, personal actual property funds, and Treasury bonds for passive earnings.

My second e-book would most likely must promote round 1 million copies to earn sufficient royalties to build up $1,875,000 in new capital. I assign a 2% likelihood of this occuring. However that also means there’s an opportunity! For context, BookScan says lower than 6.7 % of all books promote greater than 10,000 copies.

3) Do Extra Enterprise Improvement Offers on Monetary Samurai

I don’t write many product evaluate posts as a result of I’m not targeted on making most cash on Monetary Samurai. As a substitute, I wish to share human curiosity tales that relate to private finance as a result of they’re extra enjoyable to put in writing and skim.

Nonetheless, to build up $1,875,000 in further capital, I ought to be extra business-oriented on-line. Most of my friends write affiliate evaluate posts and create programs to monetize their model and platform. I’ll take into account doing the identical for merchandise I actually imagine in, put money into, or use myself.

If I attempt, I estimate I might make an extra $50,000 – $100,000 / 12 months on-line. I will then save and make investments 100% of the earnings into the S&P 500 and personal actual property funds as nicely. I anticipate runs and property costs to extend as mortgage charges decline.

To at the present time, I can’t imagine everyone can generate income on-line. This attitude comes from being a Gen Xer who clearly remembers the times earlier than the web.

4) Do Nothing And Get Fortunate

95% of my web price is tied to danger belongings. If the bull market continues, an extra $1,875,000 might come out of nowhere. My moonshot is investing in synthetic intelligence corporations with 10% of my investable capital. My treasured moonshot was investing in Tesla in 2016.

On the identical time, we might simply expertise one other 2022-like bear market, wiping away $1,875,000 or extra of my web price in only one 12 months. This massive absolute greenback swing in web price, up or down, is definitely a disincentive to work.

Let’s say I get a part-time consulting job for $150,000 a 12 months. Not dangerous, proper? I might put in 20 hours every week and take residence about $115,000 after taxes. Then to illustrate the inventory market corrects by 10%, bringing a hypothetical $3 million inventory portfolio down by $300,000. Dang, what a waste of time working!

I hate working after which dropping cash in my investments. Consequently, throughout bear markets, I wish to work much less as a result of my Return On Effort is decrease. Instances are good proper now and taxes are comparatively low, which makes work extra interesting.

A bigger web price reduces your motivation to work

On the flip facet, when a $3 million inventory portfolio is up 10% and returns $300,000, why hassle working for $115,000 after taxes until you like your job? As you become old and wealthier, that is an fascinating conundrum you might ultimately must ponder.

I take advantage of $3 million for instance as a result of I retired with a web price of about $3 million again in 2012. After enduring some treacherous years throughout the international monetary disaster, my web price lastly recovered by then.

I distinctly keep in mind feeling extremely fortunate that all the pieces bounced again. At that time, I figured the stress of labor wasn’t price it anymore. I used to be not having enjoyable and work politics have been additionally bumming me out.

All the identical, it is not in my nature to do nothing and hope for good issues to occur. So, I’ll at the very least work on my e-book and proceed writing on Monetary Samurai usually as I’ve since 2009. However going again to work full-time goes to be robust in a bear market.

Going To Have Enjoyable With My New FI Problem

Not like in my early 30s, once I was determined to flee my dreadful job, I do not really feel the identical desperation in my 40s. As a substitute, I really feel excited to have a attain monetary aim once more.

Come December 2024, I’ll have achieved my aim of being a full-time father to each of my children for 5 years. This aim has been my hardest and most important triumph. Now, full-time faculty for each children will release time to give attention to incomes once more.

Throughout this strategy of regaining monetary independence, I’ll try to have as a lot enjoyable as potential. This implies solely doing issues I get pleasure from to generate income. This additionally means consistently taking a step again and appreciating the second.

In a approach, I really feel like I am enjoying with the home’s cash. The sensation is comparable once I went to Berkeley part-time for my MBA. I already had the job that I needed, so faculty turned extra pleasing given grades not mattered as a lot.

This is hoping the bull market will proceed! Let’s have a look at what the long run holds.

Completely happy Independence Day!

Reader Questions

What stage are you in your monetary independence journey? Do you could have a set greenback quantity you are concentrating on to build up by a sure date? How do you propose to realize your FI objectives? In case you are already FI, do you imagine the journey to FI is definitely extra enjoyable than being FI?

Diversify Into Personal Actual Property

Put money into actual property extra passively and take a look at Fundrise. The agency manages $3.5 billion+ in personal actual property funds that predominantly invests within the Sunbelt area the place valuations are decrease and yields are larger. It focuses on residential and industrial industrial actual property.

My investments in personal actual property years in the past are paying off at present. They’re additionally what helped me get liquid this 12 months. After I had youngsters in 2017, I not needed to handle as many rental properties.