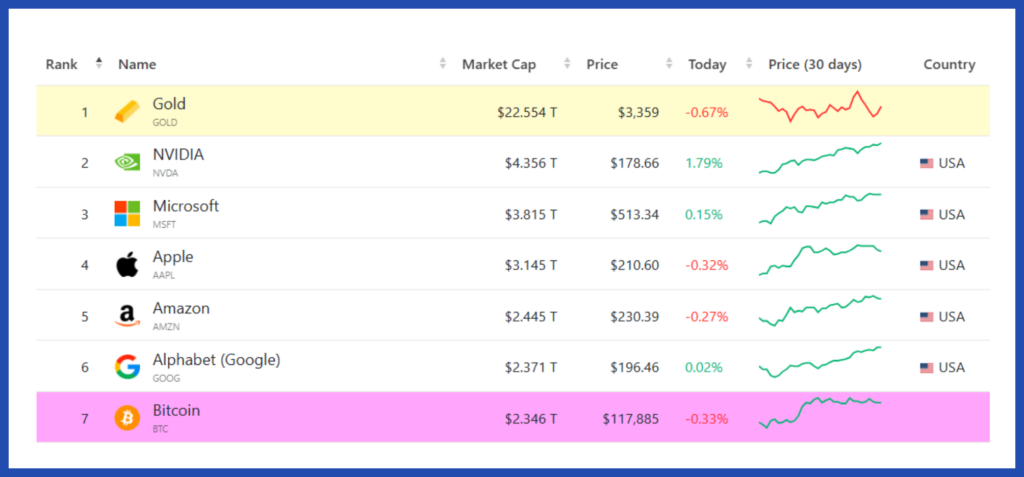

In case you missed it, bitcoin (BTC) is now the seventh-largest asset on this planet by market capitalization. Right here’s what’s forward of it.

The costs of Bitcoin (BTC), ethereum (ETH), XRP and different cryptocurrencies have been on a tear this yr on the again of assorted elements, essentially the most vital being the passing of the GENIUS Act within the U.S. This Act regulates U.S.-dollar stablecoins—cryptocurrencies pegged to the U.S. greenback, corresponding to Tether (USDT) and USDC—and in doing that, takes a serious step in the direction of regulation of crypto on this planet’s largest market, the U.S.

Let’s put crypto’s value rise into perspective. The desk under compares the share acquire of the highest three cryptocurrencies with the U.S. inventory market (S&P 500), the Canadian inventory market (S&P/TSX Composite), and gold (GLD). (Use your fingers or mouse to scroll to the precise.)

2025 has been nice for crypto buyers—however is the social gathering over, or might BTC and different crypto costs proceed to rise? Based on Tom Lee, a famend Wall Avenue analyst and bitcoin bull, BTC might rise to as a lot as $200,000 to $250,000 (all figures in U.S. {dollars}) by the tip of 2025. His view is premised on continued low rates of interest, additional addition of bitcoin to company treasuries, and powerful ETF inflows.

If earlier crypto market cycles are something to go by, Lee’s prediction of $200,000 might not be a pie within the sky. In earlier crypto bull market cycles, the market topped out on the finish of the yr following the bitcoin halving occasion. “Halving†is a four-year cyclical occasion by which the variety of cash mined per block decreases by 50%—which means the speed at which new cash are added into circulation is lower in half.Â

The desk under reveals what share BTC has gained at every market-cycle peak in comparison with its earlier market-cycle peak.

Primarily based on this knowledge, it might be affordable to count on BTC to the touch about $161,000 by the tip of 2025. Right here’s the easy back-of-the-envelope logic: BTC’s risk-return profile has moderated as its adoption has grown. Which means, its highs and lows usually are not as pronounced as they have been in earlier cycles—though they’re nonetheless excessive in comparison with main inventory indices.Â

So, let’s say BTC good points half of the share it gained within the earlier cycle. Which means, it good points 130% from its earlier cycle high—not 260% because it did final time. That might take it to $161,000. Provided that the earlier cycle tops have been in November or December of the yr following the halving, we might be taking a look at about $161,000 by the tip of this yr. After all, forecasts or predictions like this might be means off the mark—take them with a grain of salt.