U.S. Fed cuts charges for the primary time in 4 years

The U.S. greenback stays an important foreign money on the earth, and the American economic system is arguably an important monetary system as effectively. Consequently, when the U.S. Federal Reserve makes a giant announcement, it creates an financial wave that ripples all over the place. That’s why Wednesday’s resolution to chop the important thing in a single day borrowing charge by 0.50% is a really massive deal.

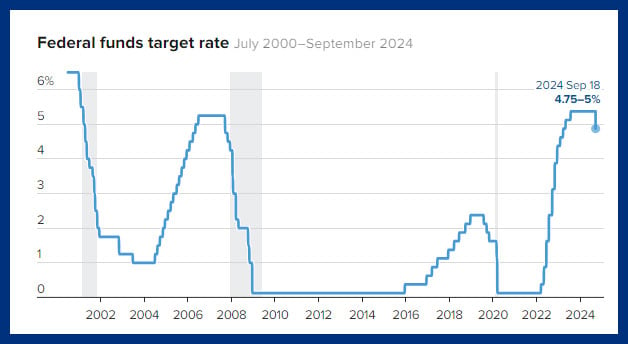

Many speculated the U.S. Fed would start chopping charges this week, but it surely was typically thought it might go along with a 0.25% drop to start an curiosity rate-cut cycle. The 50 foundation factors lower lowers the federal funds charge vary 4.75% to five%.

The U.S. Fed introduced in a press release: “The Committee has gained larger confidence that inflation is transferring sustainably towards 2%, and judges that the dangers to attaining its employment and inflation targets are roughly in stability.â€

Federal Reserve Chair Jerome Powell mentioned, “We’re attempting to attain a state of affairs the place we restore value stability with out the type of painful improve in unemployment that has come generally with this inflation. That’s what we’re attempting to do, and I feel you might take right now’s motion as an indication of our sturdy dedication to attain that purpose.â€

Instantly after the information of the U.S.’s first rate of interest cuts in 4 years, main inventory market indices responded with a quick soar on Wednesday. However they ended the day almost flat. That gave the impression to be a little bit of a delayed response from buyers, because the Bulls returned Thursday with Nasdaq hovering 2.5% and the Dow leaping 1.3% to cross 42,000 for the primary time ever.

Notably, former U.S. President Donald J. Trump continued to criticize the financial choices made by the U.S. Federal Reserve. This regardless of centuries of monetary knowledge telling us that politicians getting concerned in short-term financial coverage is a nasty thought. (See: Turkey – ErdoÄŸan, Tayyip.) At bitcoin bar PubKey on Wednesday, Trump mentioned, “The economic system can be very unhealthy, or they’re taking part in politics.â€

The larger-than-expected charge lower left some commentators questioning if this motion would spook the markets. However, if the U.S. Fed manages to string the needle and lower charges and not using a recession, it might be a very good factor. The historic precedents are very optimistic for shareholders.Â

This massive charge lower helps ease pressures on rising markets that borrowed in U.S. {dollars}. And, it takes a few of the stress off different central banks world wide that didn’t wish to see their currencies devalued an excessive amount of relative to the mighty USD.