Right here’s the difficulty: Throughout instances of maximum market stress, the company bond portion—largely BBB-rated bonds—can see their worth drop sharply and grow to be illiquid.

Why does this matter for ETFs? Throughout March 2020’s COVID crash, we noticed panicked posts from traders on Reddit like:Â

Why did some bond funds crash?

ETFs use an “in-kind†creation/redemption course of to maintain their market value aligned with their internet asset worth (NAV). When traders purchase or promote ETF models, licensed members (APs)—usually massive establishments like banks or market makers—both create new ETF models by buying the underlying bonds or redeem shares by promoting them again into the market.

When the market will get chaotic, over-the-counter traded company bonds can grow to be much more illiquid than regular—particularly in comparison with shares, which commerce on exchanges, and authorities bonds, which commerce in excessive volumes. This issues as a result of APs depend on sourcing these bonds for in-kind creations and redemptions of ETF shares. When company bonds grow to be illiquid, it will get tougher to cost them precisely, and the ETF’s market value can deviate considerably from NAV.

Consequently, in the course of the peak of the March 2020 panic, ZAG’s market value truly traded at an excessive low cost to NAV, as deep as -11.3%.Â

When you have been holding ZAG as a secure refuge, and deliberate to purchase the equities dip, this wouldn’t have labored since you would have needed to promote at a steep low cost simply to exit. ZAG wasn’t the low-risk ballast many traders assumed it could be. Sure, the low cost to NAV reversed rapidly inside days, because of speedy authorities stimulus that stabilized the market. However the COVID-19 crash was short-lived. Who is aware of what the subsequent disaster will appear to be?Â

If company bond markets freeze up once more, you may see the identical liquidity points. And if that occurs, a broad bond ETF like ZAG could not present the protection you’re relying on.

The way to keep away from a bond-market freeze

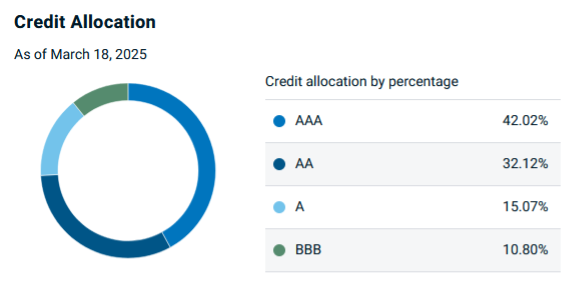

Personally, for my bond allocation, I’ve discarded combination bond ETFs like ZAG completely and rely solely on government-issued bonds. For myself, with a U.S. dollar-dominant portfolio, which means U.S. Treasuries. However for Canadians investing in Canadian {dollars}, a strong various is the iShares Core Canadian Authorities Bond Index ETF (XGB), which tracks the FTSE Canada All Authorities Bond Index.