Maple Leaf Meals is protecting a 16 per cent stake in Canada Packers and the 2 corporations have entered into an evergreen provide settlement. It’ll even be an anchor buyer for Canada Packers which is able to provide pork for its ready meats enterprise.

Michael McCain, government chair at each corporations, says Maple Leaf Meals and Canada Packers are shifting ahead as unbiased entities, every with a transparent funding profile and skilled groups. He says the McCain household and McCain Capital Inc. are totally dedicated to the way forward for each corporations.

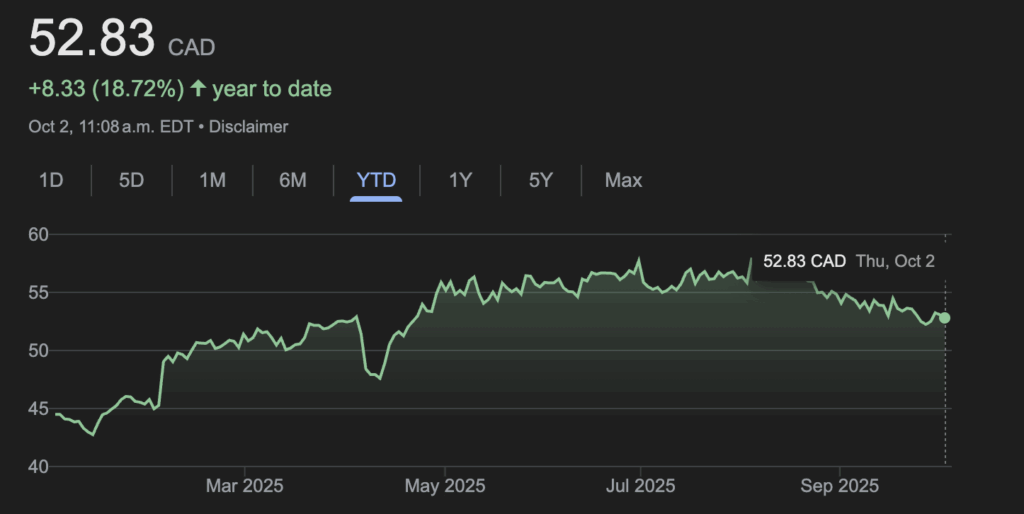

TMX Group acquires U.S.-based information and analytics supplier Verity

TMX Group (TSX:X) says it has acquired Verity, an funding analysis administration system, information, and analytics supplier. Monetary phrases of the settlement weren’t instantly out there.

Verity has two core merchandise. VerityRMS is a analysis administration system, whereas VerityData gives enhanced information units and insights primarily targeted on public fairness filings.

TMX Datalinx president Michelle Tran says the addition of Verity strengthens the corporate’s capability to serve a rising world consumer base.

TMX Group is the operator of the Toronto Inventory Change and different markets.

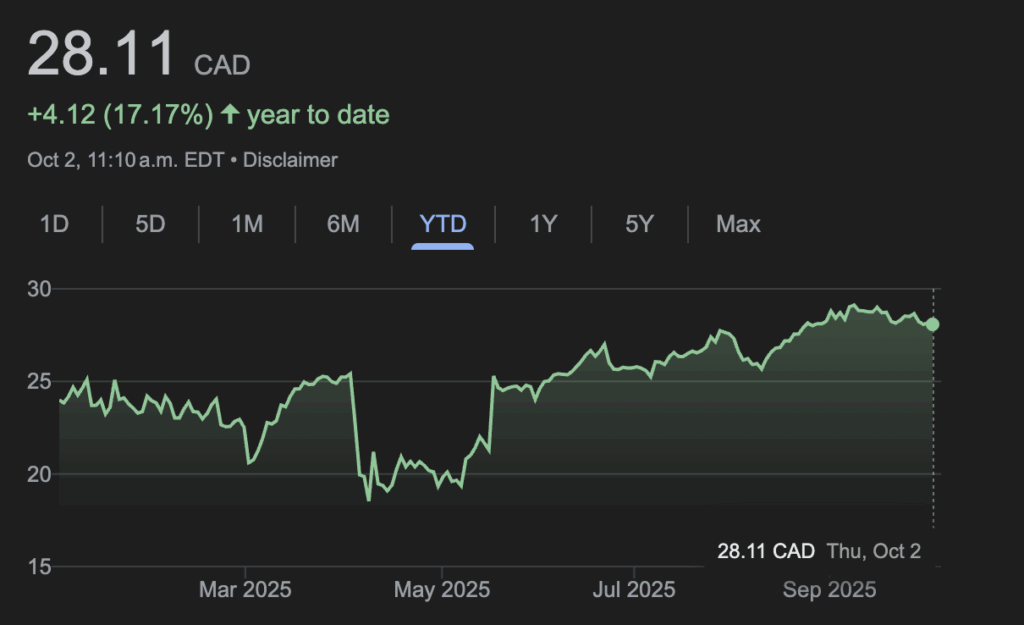

MEG Vitality says Glass Lewis recommends shareholders again Cenovus supply

MEG Vitality Corp. (TSX:MEG) says a second main unbiased proxy advisory agency has advisable its shareholders again a takeover supply for the corporate by Cenovus Vitality Inc. (TSX:CVE). The corporate says Glass, Lewis & Co. has issued a report recommending shareholders vote for the cash-and-stock supply by Cenovus over a rival all-stock supply by Strathcona Sources Ltd.

The report comes after proxy advisory agency Institutional Shareholder Providers Inc. mentioned final week that MEG shareholders ought to assist the Cenovus bid.

The Cenovus supply should be accredited by a two-thirds majority vote by MEG shareholders, anticipated to be held on Oct. 9. Strathcona (TSX:SCR) has mentioned it intends to vote its 14.2 per cent curiosity in MEG in opposition to the deal.

Cenovus and MEG have side-by-side oilsands properties at Christina Lake, south of Fort McMurray, Alta., whereas Strathcona additionally has operations within the area.

Stella-Jones indicators deal to purchase Brooks Manufacturing for US$140 million

Utility pole firm Stella-Jones Inc. (TSX:SJ) has signed a deal to purchase U.S.-based Brooks Manufacturing Co. for US$140 million.

Brooks is a maker of handled wooden distribution crossarms and transmission framing parts. It was based in 1915 and operates a facility in Bellingham, Wash.

Stella-Jones chief government Eric Vachon known as the acquisition a pure match. “The addition of Brooks bolsters Stella-Jones’ suite of options, enhancing its capability to satisfy the rising demand of utilities and unlock new progress alternatives,†Vachon mentioned in a press release Tuesday. “The acquisition displays our strategic focus and aligns with our imaginative and prescient to make Stella-Jones a associate of option to our infrastructure prospects.â€

Brooks’ gross sales for 2024 totalled about US$84 million.Â

RBC Capital Markets analyst James McGarragle known as the deal a “strategically optimistic transfer.†“It creates a beneficial progress platform for Stella-Jones by diversifying its product providing and leveraging Brooks’ established model and buyer relationships,†McGarragle wrote in a notice to shoppers. “Moreover, the acquisition aligns with Stella-Jones’ long-term strategic targets to increase past conventional product classes and speed up progress within the infrastructure section, positioning the corporate to capitalize on ongoing investments in utility modernization.â€

The deal is topic to closing situations, together with U.S. regulatory approval, and is predicted to happen by the top of the yr. The deal for Brooks follows the acquisition by Stella-Jones of Locweld Inc., a designer and producer of lattice transmission towers and metal poles, earlier this yr.