Solely when the inventory market goes down do folks begin to wonder if they’ve an excessive amount of publicity to shares (equities). Questions come up: Ought to I reduce? Ought to I purchase the dip? What’s the suitable allocation to shares proper now?

Whereas the reply is dependent upon many variables—your danger tolerance, age, internet price, present asset allocation, and monetary targets—determining the correct amount of inventory publicity doesn’t must be sophisticated.

A Easy Inventory Publicity Litmus Check

In the event you’re a working grownup, right here’s a straightforward approach to decide whether or not your inventory publicity is suitable:

Calculate your paper losses in the course of the newest market correction and divide that quantity by your present month-to-month revenue.

This provides you a tough estimate of what number of months you’d must work to make up on your inventory market losses, assuming no rebound. It’s a part of my SEER formulation that helps decide your true danger tolerance.

Inventory Market Publicity Instance:

Let’s say you could have a $1 million portfolio, totally invested within the S&P 500. The market corrects by 20%, so that you’ve misplaced $200,000. In the event you make $15,000 a month, you’d have to work 13.4 months to make up for the loss.

If the thought of working 13.4 further months doesn’t faze you—possibly since you’re underneath 45, get pleasure from your job, or have loads of different belongings—then your inventory publicity is perhaps good. You may even need to make investments extra.

But when the considered working over a yr simply to get well your losses is miserable, your publicity to equities is perhaps too excessive. Think about decreasing it and reallocating to extra secure investments like Treasury bonds or actual property.

A Actual Case Research: Method Overexposed To Shares

Right here’s an actual instance I got here throughout: A pair of their mid-50s with a $6.5 million internet price at the start of the yr, consisting of $6 million in shares and $500,000 in actual property. They spend not more than $100,000 a yr.

Within the first 4 months of 2025, they misplaced $1 million from their inventory portfolio, which dropped to $5 million. With a most month-to-month spend of $8,333 (or ~$11,000 gross), they successfully misplaced 90 months of gross work revenue—that’s 7.5 years of working simply to get well their losses.

For a pair of their mid-50s, dropping that a lot money and time is unacceptable. They have already got sufficient to dwell on comfortably. A 4% return on $6 million in Treasury bonds yields $240,000 a yr risk-free. That is twice their spending wants with nearly no danger.

This couple is both chasing returns out of behavior, unaware of their true danger tolerance, or just by no means obtained considerate monetary steerage. Getting your funds reviewed by a 3rd get together is a no brainer.

As I seek the advice of with extra readers as a part of my Millionaire Milestones ebook promotion (click on for extra particulars if ), I understand all people has a monetary blindspot that wants optimizing.

Time Is the Greatest Measure of Inventory Publicity

Why will we make investments? Two foremost causes:

- To become profitable to purchase issues and experiences.

- To purchase time—so we don’t must work eternally at a job we dislike.

Between the 2, time is much extra precious. Your objective shouldn’t be to die with probably the most cash, however to maximize your freedom and time whilst you’re nonetheless wholesome sufficient to get pleasure from it.

Certain, you may evaluate your losses to materials issues. For instance, when you’re a automotive fanatic and your $2 million portfolio drops by $400,000, that’s 4 $100,000 dream vehicles gone. However measuring losses by way of time is a much more rational and highly effective method.

As you become old, this turns into much more true—since you merely have much less time left.

Threat Tolerance Information For Inventory Publicity

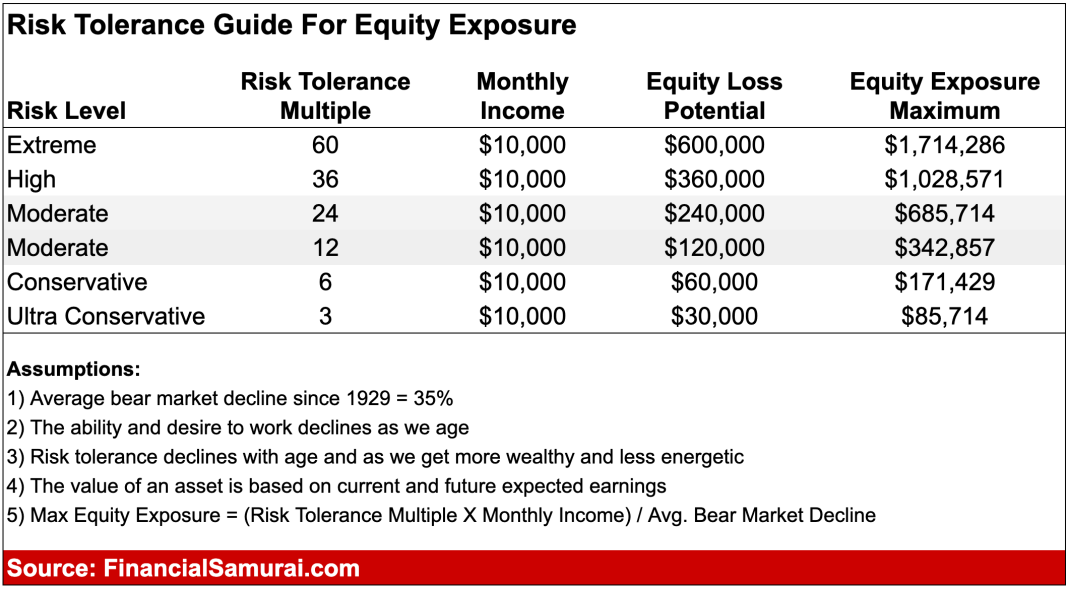

This is a desk that highlights the Threat Tolerance A number of, expressed by way of working months. Your private danger tolerance will fluctuate, so contemplate developing the rest of your portfolio with bonds, actual property, or different much less unstable belongings.

For instance, when you earn $10,000 a month and have an excessive danger tolerance, you is perhaps comfy allocating as much as $1,714,286 of your $2,000,000 funding portfolio to shares. The remaining $285,714 can go into bonds or different much less unstable belongings. Alternatively, you may hold your complete portfolio in shares till reaching the $1,714,286 threshold.

My Private Perspective on Time and Inventory Publicity

Since I used to be 13, I’ve valued time greater than most. A buddy of mine tragically handed away at 15 in a automotive accident. That occasion deeply formed how I method life and funds.

I studied onerous, landed a high-paying job in finance, and saved aggressively to achieve monetary independence at age 34. My objective was to retire by 40, however I left at 34 after negotiating a severance that lined 5 to 6 years of dwelling bills. I’ve acted congruently with how I worth time – it’s far more essential than cash.

Since retiring in 2012, I’ve saved my inventory publicity to 25%–35% of my internet price. Why? As a result of I’m not keen to lose greater than 18 months of revenue in the course of the common bear market (-35%), which tends to occur each three to seven years. That’s my threshold. I by no means need to work for any individual else once more full-time, particularly now that I’ve younger kids.

They are saying when you’ve received the sport, cease enjoying. But right here I’m nonetheless investing in danger belongings, pushed by inflation, some greed, and the will to maintain my household.

Adjusting Inventory Publicity by Time Keen to Work

Within the earlier instance, I suggested the couple with $6 million in shares to scale back their publicity based mostly on their month-to-month spending, which I translated right into a gross revenue equal. A $1 million loss in a market downturn would equate to roughly 90 months of spending—or about 8 years of labor—based mostly on their $8,333 month-to-month spending and $11,000 gross revenue.

In the event that they’d be extra comfy dropping the equal of simply 30 months of revenue, they need to restrict their inventory publicity to roughly $2 million. That method, in a 16.7% correction, they’d lose not more than $330,000 (30 X $11,000/month in gross revenue).

One other Resolution Is To Earn Extra Or Spend Heaps Extra Cash

Alternatively, they might justify their $6 million inventory publicity by growing their month-to-month revenue to $33,333, or to $400,000 a yr. However extra simply, increase their after-tax spending from $8,333 ($11,000 gross), to about $25,000 ($33,000 gross). That method, a $1 million loss represents simply 30 months of labor or spending.

In fact, it’s financially safer to spice up revenue than to spice up spending. However these are the levers you possibly can pull—revenue, spending, and asset allocation—to align your portfolio along with your willingness to lose time.

When you’ve got a $6.5 million internet price and solely spend $100,000 a yr, you’re conservative. The 4% rule suggests you may safely spend as much as $260,000 gross a yr, which nonetheless offers you loads of buffer. Therefore, this couple ought to dwell it up extra or give extra money away.

Time Is the Best Alternative Price

I hope this framework helps you rethink your inventory publicity. It’s not about discovering an ideal allocation. It’s about understanding your alternative value of time and aligning your investments along with your targets.

Shares will at all times really feel like humorous cash to me till they’re offered and used for one thing significant. That’s when their worth is lastly realized.

If this latest downturn has you depressed due to the time you’ve misplaced, your publicity is probably going too excessive. However when you’re unfazed and even excited to purchase extra, then your allocation is perhaps good—and even too low.

Fortunately, the inventory market has at all times rebounded, so needing to work X variety of months to get well your losses isn’t at all times crucial—offered you possibly can maintain on. Nonetheless, measuring your losses by way of time is likely one of the handiest methods to evaluate whether or not your present inventory publicity is suitable. Better of luck!

Readers, how do you identify your acceptable quantity of inventory publicity? What number of months of labor revenue are you keen to lose to make up on your potential losses?

Order My New E book: Millionaire Milestones

If you wish to construct extra wealth than 93% of the inhabitants and break away sooner, seize a duplicate of my new ebook: Millionaire Milestones: Easy Steps to Seven Figures. I’ve distilled over 30 years of expertise right into a sensible information that can assist you change into a millionaire—or perhaps a multi-millionaire. With sufficient wealth, you should buy again your time, probably the most precious asset of all.

Choose up a duplicate on sale at Amazon or wherever you get pleasure from shopping for books. Most individuals don’t take the time to learn private finance articles—not to mention books about constructing monetary freedom. By merely studying, you’re already gaining a significant benefit.

Monetary Samurai started in 2009 and is likely one of the main independently-owned private finance websites at present. Since its inception, over 100 million folks have visited Monetary Samurai to realize monetary freedom sooner. Join my free weekly publication right here.