Actual property is inherently native, with property values carefully tied to the financial drivers and traits of particular areas. Whereas understanding the nationwide housing worth forecast for 2025 gives precious context, savvy traders ought to give attention to figuring out cities and states with stronger development potential. In any case, outperforming the market is simply as essential as producing returns.

One compelling space to observe is cities experiencing a better proportion of employees returning to the workplace. Since 2020, thousands and thousands of employees reaped the advantages of work-from-home insurance policies, however there are rising indicators that this pattern is reversing.

As extra corporations push for in-office attendance, cities with sturdy office-based economies and rising office reoccupancy charges may see a surge in housing demand. This shift could result in larger property worth appreciation in these areas as employees relocate nearer to their workplaces, revitalizing city facilities.

Investing In Cities That Are Returning To The Workplace

Very like “Zoom Cities†equivalent to Boise, Idaho, thrived in the course of the remote-work increase, cities seeing a shift again to in-office work are more likely to expertise housing demand spikes. Whereas most employees favor flexibility, corporations pushing for a return to the workplace will drive demand in city areas.

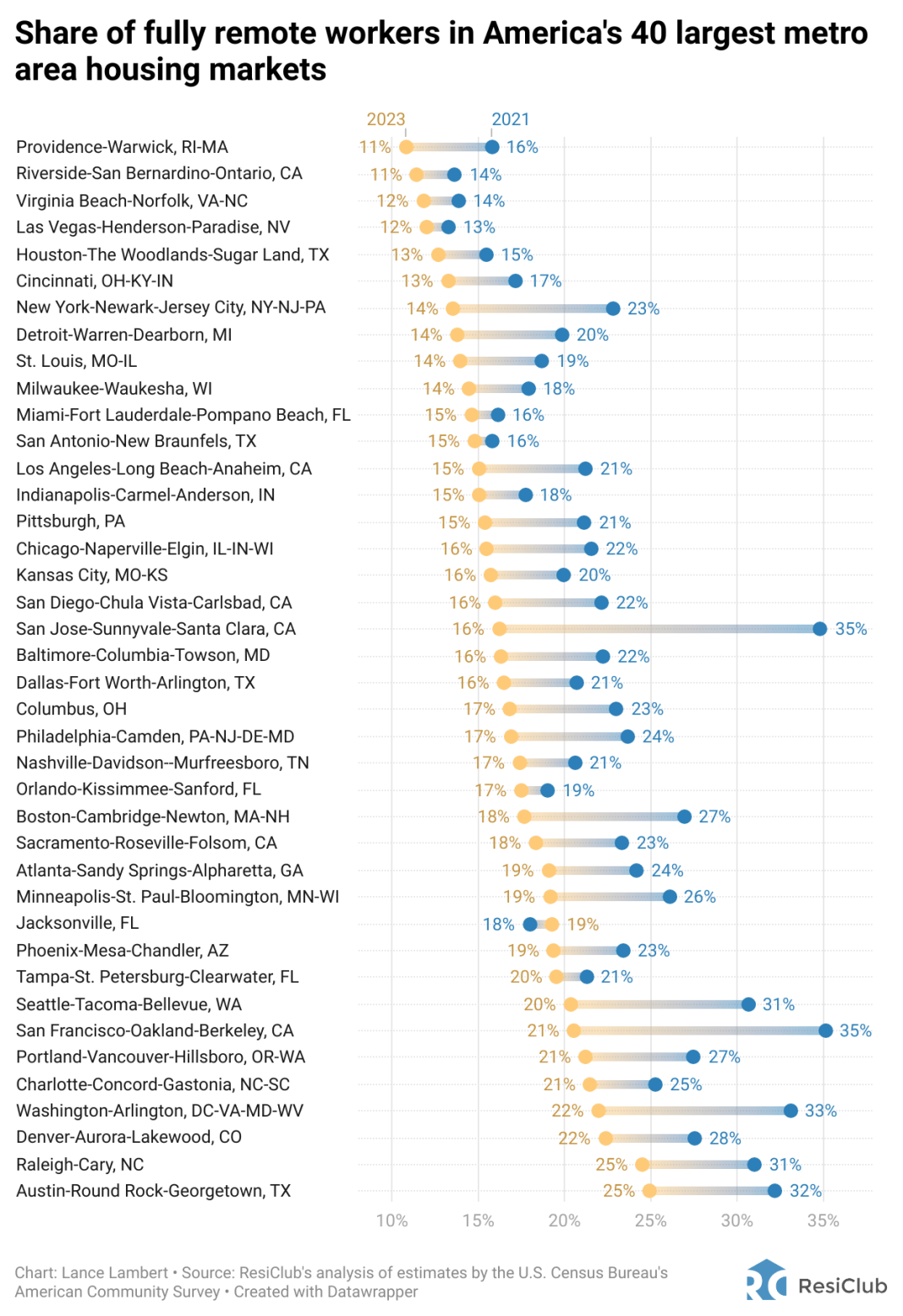

Latest information exhibits the greatest drops in totally distant employees are in metro areas like:

- San Jose-Sunnyvale-Santa Clara (35% totally distant all the way down to 16% in 2023 and going decrease)

- San Francisco-Oakland-Berkeley (35% -> 21%)

- New York-Newark-Jersey Metropolis (23% -> 14%)

- Boston-Cambridge-Newton (27% -> 18%)

- Seattle-Tacoma-Bellevue (31% -> 20%)

- Los Angeles-Lengthy Seashore-Anaheim (21% -> 15%)

- Washington, D.C.-Arlington (33% -> 22%)

Check out this extra complete chart compiled by Lance Lampert, author of the ResiClub e-newsletter.

Widespread Theme Amongst Cities with the Biggest Return-to-Workplace Shifts

A key attribute of cities experiencing the strongest return-to-office developments is their inherent issue in including new housing provide. Years of undersupply have primed these cities for heightened competitors, possible resulting in bidding wars that drive up each rents and property costs. As extra employees return, demand will rise for each residential and business properties, making these cities hotspots for actual property exercise.

The transition gained’t create a right away increase. Initially, current stock can be absorbed as migrants and workplace tenants modify to shifting dynamics. Nonetheless, as soon as return-to-office norms stabilize, the strain on restricted housing inventory is predicted to push costs increased. The interaction of strict land-use laws and low loan-to-value ratios amplifies this impact.

Take San Francisco for example. Constructing new houses is notoriously tough on account of stringent laws and excessive building prices. Securing a constructing allow usually takes years, assuming the property is even zoned for improvement. You then’ve acquired to construct the darn construction! I attempted getting a allow to construct an ADU previously and gave up after six months.

With tech corporations thriving and imposing hybrid work insurance policies requiring not less than three in-office days, housing demand is intensifying in tech hubs like San Francisco, San Jose, and surrounding areas.

The continuing bull market is driving important wealth creation, which not solely attracts extra employees to those areas but additionally channels substantial firm inventory capital into actual property investments.

The one solution to really get pleasure from your inventory good points is to make use of them to purchase one thing significant or fulfilling. This twin impact—rising demand from staff and heightened buying energy from fairness good points—additional amplifies competitors for housing in these high-growth areas.

The Return Of Massive Metropolis Actual Property

Like so many issues – politics, social justice points, schooling developments, well being developments – the pendulum tends to swing from one excessive to a different. The Sunbelt and Midwest areas had their time within the solar from 2017-2022. Now, cities like Austin are coping with a hangover as builders work by their stock. Maybe in 2026 or 2027, will probably be increase instances for them as soon as once more on account of a then undersupply of housing.

However for subsequent a number of years, I think huge metropolis actual property will begin outperforming on account of return to work insurance policies. So in the event you personal property in one of many cities with the best return to workplace shifts, I might maintain on. Should you’ve been eager about constructing a rental property portfolio, you might need to purchase earlier than a big liquidity wave of tech and AI corporations enriches tens of 1000’s of staff.

And in the event you’ve been a long-time landlord who’s seeking to simplify life and earn extra pure passive earnings, your time to make the most of energy and promote could also be coming.

Workers And Employers Are Rational Actors

Individuals who need to receives a commission and promoted can be complying with their firm’s return to workplace insurance policies. And the overwhelming majority of employees need to receives a commission and promoted.

In the meantime, corporations with senior administration that when championed work-from-home insurance policies are beginning to acknowledge that fostering in-person collaboration is important to remain aggressive. They’re pushed by the attract of mega-million-dollar windfalls. That’s capitalism in motion!

Sure, it’s unhappy that the great instances are over for a lot of who need to return to the workplace. However all good issues should come to an finish. On the very least, you’ll be able to put money into corporations which might be taking work extra significantly to drive earnings and returns for you. Then you can even put money into actual property in cities the place these corporations are based mostly.

For life-style functions, intention to work for corporations that allow you to get pleasure from perks like enjoying pickleball in the course of the day whereas nonetheless getting paid. These alternatives will turn out to be more and more uncommon, so in the event you discover one, worth it as a lot as you’d an trustworthy auto mechanic or a reliable handyman.

Retirees Profit From Return To Workplace As Nicely

For retirees, life will get a bit extra peaceable. Reserving courts, catching matinees, and strolling by parks will possible turn out to be simpler with out the identical weekday crowds. Errands will take much less time, and your favourite spots will really feel much less congested.

As thousands and thousands return to fluorescent-lit workplaces in pursuit of extra money, your choice to step away from the grind will repay additional—granting you larger serenity and freedom.

Psychologically, there’s a reassuring sense of satisfaction understanding that the staff in your funding corporations are placing in additional effort in your behalf. Whereas funding returns are by no means assured, it’s comforting to really feel that the odds of sustaining a snug retirement are bettering.

What a present it’s to see staff returning to the workplace and striving for development as soon as once more!

Readers, what are your ideas on investing in actual property in cities the place staff are returning to the workplace in important numbers? Do you consider big-city actual property is poised to outperform smaller markets that benefited from the work-from-home pattern? Share your insights beneath!

Make investments In Actual Property StrategicallyÂ

Should you do not need to purchase and handle bodily rental properties, contemplate investing in non-public actual property funds as a substitute. Fundrise is platform that allows you to 100% passively put money into residential and industrial actual property. With solely a $10 minimal to speculate, you’ll be able to simply dollar-cost common into actual property with out the effort of being a landlord. .

I’ve personally invested over $290,000 with Fundrise, they usually’ve been a trusted associate and long-time sponsor of Monetary Samurai.