With fears of a recession rising once more largely because of the Trump administration’s aggressive coverage measures—tariffs, spending cuts, aggressive layoffs, and an more and more combative commerce stance—it’s time to awaken the vulture investor inside. Each Primary Avenue and Wall Avenue are prone to dropping some huge cash now.

I don’t significantly benefit from the thought of being a vulture investor. It feels exploitative, capitalizing on the misfortune of others. However in a capitalistic society, opportunism isn’t simply inspired—it’s important for survival. If the fast indiscriminate firings of federal authorities staff train us something, it is that the wealthy and highly effective do not care about you! Subsequently, you have to change your mindset to go on the offensive.

Each market downturn triggers a wealth switch, shifting cash from the unprepared to the ready, from the weak to the robust. In the event you refuse to undertake a vulture mindset throughout unsure occasions, you threat changing into the prey. Embracing this method is each a defensive safeguard and an offensive technique for seizing alternatives.

A Bear Market Might Simply Come Again

We’ve simply skilled two phenomenal years of inventory market returns. A pure reversion to the historic valuation imply of 18x earnings may simply pull the S&P 500 down by 15% or extra from present ranges. In that case, we must always count on to see an acceleration of mass layoffs.

Whereas that draw back transfer could seem excessive, so is the continued tariff flip-flopping, which in the end hurts shopper sentiment. Give it some thought—if confidence sooner or later fades, the logical response is to save lots of, not spend. If too many individuals begin saving, a recession ensues.

Though the NASDAQ has corrected by ~11% already, there’s not precisely blood on the streets but, with the S&P 500 solely down about ~7.5% from its peak. Nevertheless, if self-inflicted wounds proceed to mount, a savvy vulture investor is aware of to maintain money able to pounce on rising alternatives.

The Objective of a Vulture Investor

A vulture investor’s mission is straightforward: establish distressed belongings, look forward to capitulation, and strike when the value is correct.

Like precise vultures circling the dying, monetary vultures should train persistence and self-discipline. As a substitute of chasing belongings at inflated costs, you have to look forward to pressured sellers—those that can not maintain on resulting from extreme debt, financial hardship, or mismanagement.

I’ve made vulture investing sound immoral because of the phrase “vulture.†I may have simply modified the time period to “Alternative Investing†or “Strategic Investing†to make being opportunistic sound higher. Nevertheless, in a free market, most of us have the power to purchase or promote something we wish.

The early warning indicators are already right here:

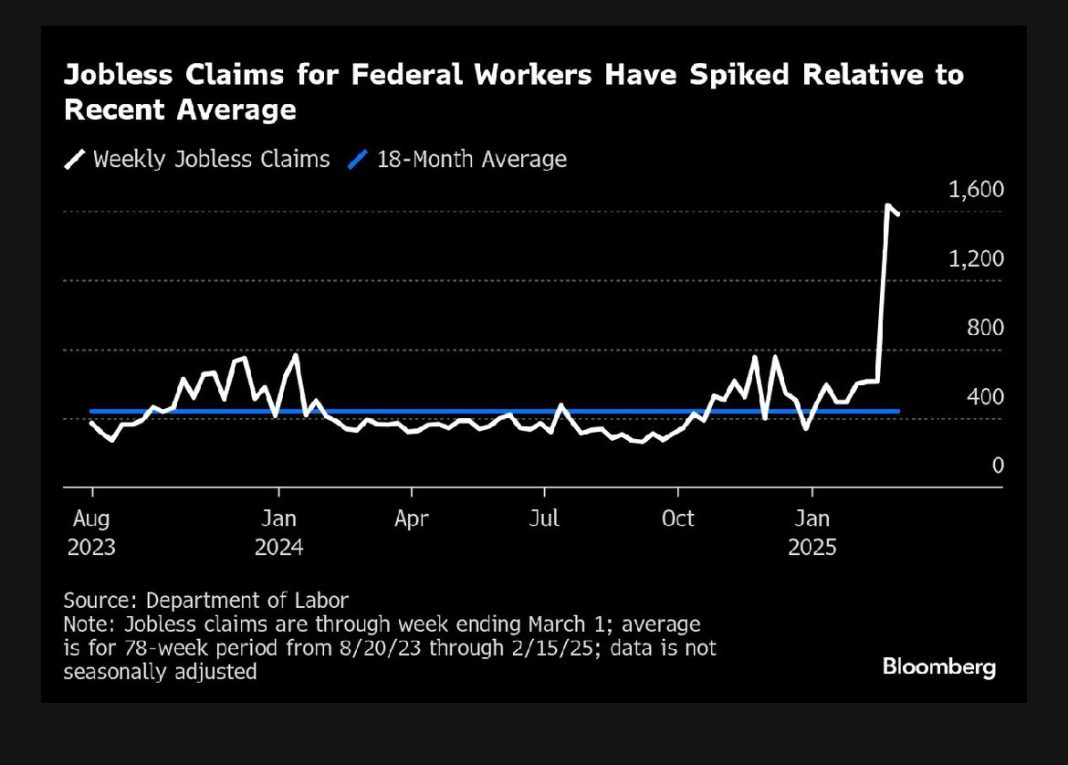

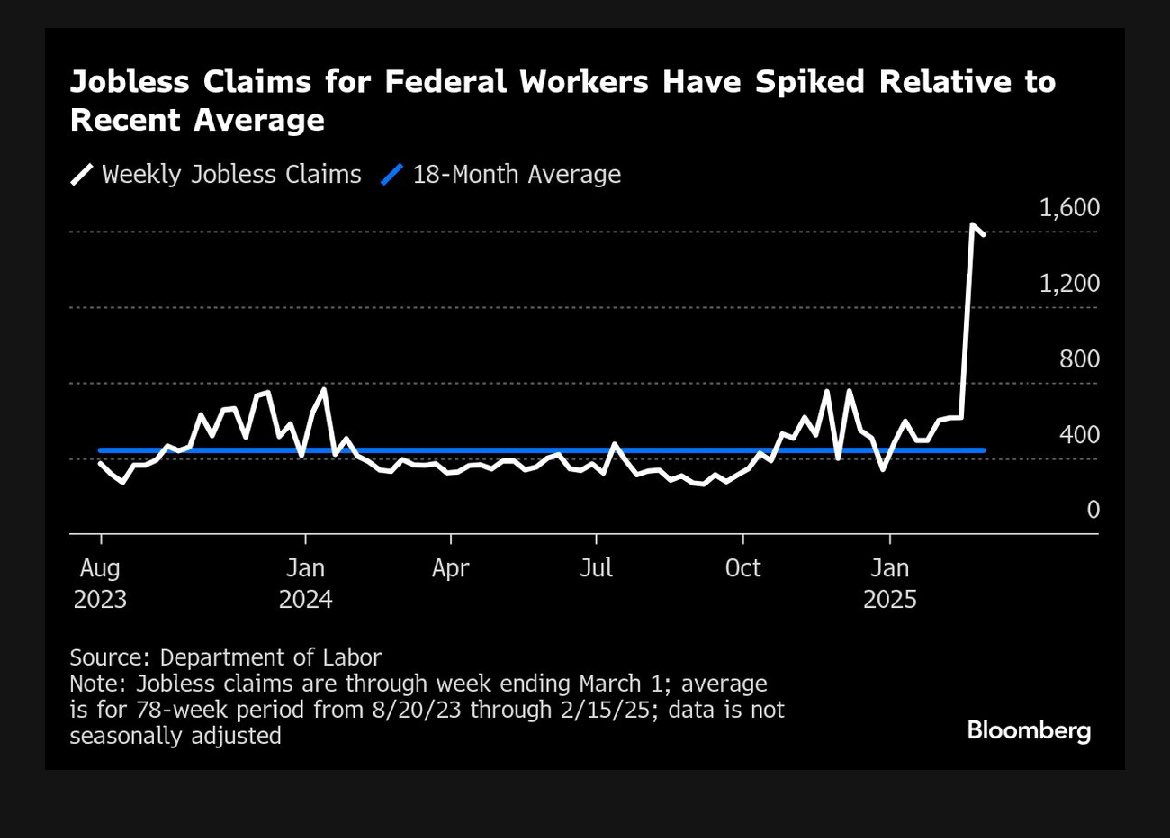

Job cuts are accelerating – Corporations are trimming fats, getting ready for leaner occasions. Layoffs ripple via native economies, creating secondary misery in housing, shopper spending, and small enterprise revenues.

Family debt ranges and delinquencies are inching larger – Some owners stretched themselves skinny to afford property at traditionally low rates of interest. Whereas bank card debt and auto mortgage debt proceed to rise. With charges nonetheless elevated, carrying prices are biting onerous.

Industrial actual property stays fragile – Workplace vacancies are nonetheless excessive, and if firms begin downsizing additional, landlords with an excessive amount of leverage could possibly be in large hassle.

Erratic and unpredictable authorities – When authorities actions are inconsistent, it turns into troublesome to make dependable projections about an organization’s efficiency and the broader economic system’s route. The free market needs much less authorities intervention, no more.

GDP development is decelerating or could even be declining – The Atlanta Fed is forecasting 1Q2025 GDP development of -1.5%.

Who to Prey On as a Vulture Investor

To capitalize, vulture traders should know the place to search for alternative. As long as the funding is authorized, it’s inside your proper to make the most of the state of affairs. Listed below are some targets to contemplate:

1. Householders Who Overleveraged

Throughout the post-pandemic housing growth, many consumers ignored conventional affordability guidelines. As a substitute of following the 30/30/3 rule (spend not more than 30% of gross earnings on a mortgage, put down no less than 30%, and don’t purchase a house greater than 3x your annual earnings), they stretched themselves skinny, banking on low mortgage charges and rising house costs.

Now, with persistently excessive rates of interest and rising layoffs, pressured promoting and foreclosures may improve. This can be very true in states that overbuilt, resembling Florida, Texas, Tennessee, and Colorado. Moreover, mass layoffs within the Washington D.C. space may result in a surge in house listings as owners downsize. A savvy vulture investor displays foreclosures traits and waits patiently for properties to hit public sale at steep reductions.

2. Small Enterprise House owners Who Took On Too A lot Debt

The surge in small enterprise formation throughout 2020-2022 was spectacular, however many companies survived on low cost debt and authorities assist. Now, with larger borrowing prices and weaker shopper spending, these with out robust money movement or pricing energy will wrestle.

As a vulture investor, you possibly can search for:

• Companies pressured to liquidate belongings at reductions (actual property, tools, mental property).

• Buying distressed firms with robust fundamentals however short-term money movement points.

• Shopping for into struggling however promising startups at fire-sale valuations. Throughout downturns, shopper development slows and it is a lot tougher to get funding.

3. Overleveraged Industrial Actual Property House owners

Though recovering, the business actual property sector stays in a precarious place. If a recession hits, the post-pandemic return-to-office development could stall, as firms will freeze hiring or downsize, lowering workplace area demand additional.

In the meantime, many landlords refinanced their properties at rock-bottom rates of interest and at the moment are dealing with ballooning debt funds with few choices to refinance affordably. Those that can’t restructure can be pressured to promote, creating prime alternatives for deep-pocketed traders.

The simplest manner I’ve discovered to achieve business actual property publicity is to take a position via Fundrise. With an funding minimal of solely $10, it is easy to dollar-cost common in. Personally, I’ve invested over $300,000 with them and can proceed to dollar-cost common given I see good relative worth.

4. Giant Companies With Extreme Debt

Company debt ranges soared when charges have been close to zero. Now, with borrowing prices a lot larger, overleveraged corporations face an earnings squeeze. The weakest firms will:

• Dump divisions or belongings at distressed costs.

• Restructure via chapter, wiping out present shareholders.

• Challenge dilutive secondary inventory choices to remain afloat.

Vulture traders can revenue by:

• Shopping for bonds of distressed firms at steep reductions.

• Buying cash-generating divisions spun off by struggling corporations.

• Brief-selling overvalued, debt-laden firms earlier than they collapse.

5. Panic Sellers within the Inventory Market

The sweetness and curse of the inventory market is its emotional nature. Concern-driven promoting can create unbelievable bargains, very like we noticed in March-April 2020 when nice firms have been buying and selling at absurdly low valuations.

Vulture traders:

• Construct a watchlist of high-quality firms with robust fundamentals (robust free money movement, giant stability sheets, giant moat, and so forth) which will get unfairly punished by panic.

• Search for indiscriminate promoting based mostly on macroeconomic and policy-driven panic quite than company-specific issues.

• Use dollar-cost averaging to purchase in phases as costs fall additional.

6. Former Startup Workers with Illiquid Inventory

In troublesome occasions, some staff holding inventory choices or fairness in personal firms could look to dump their shares at a reduction. Vulture traders can:

- Purchase shares in struggling however promising personal firms on the secondary market.

- Search for pre-IPO firms with robust fundamentals however non permanent money movement points.

- Negotiate with ex-employees who want liquidity earlier than an organization can go public or be acquired.

7. Trip Householders Hit by Rising Prices

Many consumers rushed into trip houses through the pandemic, anticipating robust rental demand to subsidize working prices. Now, with larger mortgage charges, insurance coverage prices, and a slowdown in trip house purchases, some are struggling to carry on. Vulture traders can:

- Scoop up discounted trip properties in overbuilt markets.

- Goal Airbnb traders who can not cowl their prices.

- Search for resort-area actual property owned by overleveraged traders.

8. Distressed Luxurious Asset Sellers

Financial downturns typically drive people to promote luxurious belongings at a reduction. Alternatives embody:

- Excessive-end watches from manufacturers like Rolex and Patek Philippe.

- Basic and unique vehicles that require expensive upkeep.

- Yachts and personal planes from house owners trying to downsize their life.

9. Overleveraged Crypto and NFT Speculators

The crypto growth led many traders to borrow in opposition to their digital belongings. Now, with crypto market volatility, some could also be pressured to promote:

- Bitcoin, Ethereum, and different belongings at distressed costs.

- Excessive-value NFTs from collections like Bored Ape Yacht Membership or CryptoPunks.

- Crypto-backed actual property and different belongings which have gone underwater.

10. Landlords Fighting Lease Management and Evictions

In cities with strict hire management legal guidelines or sluggish eviction processes, some landlords could also be unable to lift rents or take away non-paying tenants. This will push them to promote properties under market worth. Vulture traders can:

- Goal distressed multi-family properties the place house owners are bored with coping with laws.

- Purchase single-family leases from landlords who can’t sustain with rising prices and stagnant hire development.

- Hunt down mom-and-pop landlords trying to exit the rental enterprise altogether.

11. Divorcees Dealing with Asset Liquidation

Divorce typically forces the sale of belongings, together with houses, companies, and funding portfolios, at inopportune occasions. One partner might have to dump actual property rapidly to divide belongings, or a enterprise could possibly be bought under honest worth to settle a cut up. Vulture traders can:

- Determine luxurious properties being bought at a reduction resulting from divorce settlements.

- Search for companies that one partner is pressured to promote, particularly these with robust fundamentals however non permanent misery.

- Purchase out funding portfolios or personal fairness stakes that one partner must liquidate.

12. Overleveraged Automobile House owners Dealing with Repossession

Shopping for an excessive amount of automobile is the #1 private finance wealth killer. This realization led me to develop the home-to-car worth ratio, a easy guideline to assist individuals make smarter spending choices. The latest surge in automobile mortgage delinquencies means that many homeowners, significantly these with luxurious automobiles, are struggling to maintain up with their funds. Vulture traders can:

- Purchase repossessed automobiles at public sale for resale or rental fleets.

- Supply private-party money offers to determined sellers earlier than repossession.

- Purchase automobile rental companies liquidating their stock resulting from monetary struggles.

The Energy of Money: Your Final Weapon

The very best vulture traders don’t simply acknowledge alternative—they’ve the liquidity and the braveness to behave. Most individuals who get into hassle achieve this by taking over extreme debt, leaving them susceptible when a downturn hits.

One of many greatest dangers in a downturn is being pressured to promote belongings on the worst time. Savvy traders keep away from this destiny by sustaining robust money reserves and having a transparent recreation plan for when to deploy capital.

In the event you’re sitting on money, a downturn isn’t one thing to worry—it’s a chance. The extra uncertainty and panic out there, the extra negotiating energy you could have as a purchaser.

Neglect about solely have six months of dwelling bills in money. A vulture investor has years of money able to deploy!

So Wealthy You Don’t Care How A lot You Quickly Lose

One of many greatest risks of electing billionaires policymakers to run the economic system is that they won’t really feel as a lot ache as the remainder of us throughout downturns. When you could have tons of of tens of millions or billions in wealth, dropping some huge cash means nothing.

However for the common investor, home-owner, or small enterprise proprietor, a downturn could be catastrophic. That’s why considering like a vulture investor isn’t nearly creating wealth—it’s about monetary survival. You hope you by no means have to enter vulture investing mode, however you are ready if it’s worthwhile to.

Whether or not you prefer it or not, downturns can create life-changing alternatives for individuals who are ready. Those that wolfed up shares and actual property through the 2008 World Monetary Disaster are sitting on enormous fortunes in the present day. In the meantime, those that bought shares and foreclosed on their houses again then have probably fallen behind for good.

If historical past is any information, wealth will as soon as once more switch from the weak to the robust, from the overleveraged to the liquid, from the fearful to the opportunistic.

The query is: Which aspect will you be on?

Solutions To Enhance Your Funds

To raised plan to your monetary future, take a look at ProjectionLab. It permits you to create a number of “what-if†eventualities to arrange for any state of affairs. The extra you intend, the higher you possibly can optimize your monetary choices.

Hear and subscribe to The Monetary Samurai podcast on Apple or Spotify. I interview consultants of their respective fields and focus on among the most attention-grabbing matters on this web site. Your shares, scores, and opinions are appreciated.

To expedite your journey to monetary freedom, be a part of over 60,000 others and subscribe to the free Monetary Samurai e-newsletter. Monetary Samurai is among the many largest independently-owned private finance web sites, established in 2009. All the pieces is written based mostly on firsthand expertise and experience.