To start with, investing was easy.

A bunch of men sat round a buttonwood tree on Wall Avenue (not actually however you get the image). To purchase and promote shares, you needed to name to a stockbroker. It was easy however costly (0.25% fee per commerce!).

At this time, investing appears difficult as a result of it has loads of elements. There are equities and bonds, derivatives and choices, mutual funds and index funds, and many others. So many phrases, however lots of them you do not each want.

At its core, investing continues to be fairly easy if you happen to battle to maintain it that manner.

And as is the case with every thing in life, easier is healthier.

Why Do We Search Complexity?

We discover consolation in complexity.

Investing is about getting ready for the long run and the long run is unpredictable. Our future can also be essential. You do not wish to mess it up.

When we have now to select in the present day about that unsure future, we get anxious. We’re scared.

Within the face of that, it is simpler to lean on specialists and complexity as a result of it feels like we’re doing extra.

And a few specialists love this as a result of it is a possibility to earn cash. 💵💵💵

For those who spend hours on a sport plan and it fails, you may level to all of the work you probably did and folks extra willingly settle for the failure. For those who spend minutes on a sport plan and it fails, individuals will query your dedication and arduous work. Why did you solely spend a couple of minutes on one thing so essential?

If we spend loads of time constructing a fancy system, it has to work higher than one thing easy, proper?

Have a look at how difficult it was!!!

And if we recruit specialists, it provides much more credibility. You pay for the experience but additionally the the peace of thoughts that comes with that experience.

Whereas complexity is just not all the time unhealthy, it is all the time dearer.

Lastly, the plan itself is just not transformational. It is higher than having no plan however you continue to need to execute it.

Typically your assumptions will not cooperate. For those who count on the inventory market to return 7-8% per yr for forty years but it surely solely gives 3% (or your retire on the flawed time), your plan could have failed by way of no fault of your individual.

Complexity would not assure success.

Oh, and there may be nothing flawed with pay for peace of thoughts, so long as you already know you are doing it..

To Win At Investing, You Solely Want Three Steps

There are three elements to a profitable portfolio:

- Common contributions (save early and infrequently)

- Correct asset allocation primarily based in your wants & objectives (adjusting as vital)

- Go away it the f* alone (and wait)

That is it.

However you may’t earn cash promoting that. For this reason everybody agrees on that method however they give attention to #2 – what you put money into. That is the place individuals can earn a boatload of charges and commissions if they’ll steer you to their merchandise.

What About Personal Wealth Administration?

If issues are so easy, why does wealth administration exist?

First, generally you have made a lot cash that you just wish to outsource a few of your work. Many individuals have home cleaners as a result of they do not wish to clear their home. Many have landscapers as a result of they do not wish to rake their leaves.

It is not that they do not know find out how to clear their bogs or trim their hedges, they merely do not wish to and are pleased to pay somebody to do it. The identical is true for managing your cash.

However do the rich get entry to investments you or I can’t?

Certain – but it surely does not imply they carry out higher.

This can be a nice Twitter submit by Moiz Ali, who based Native Deodorant and bought it for $100 million to Proctor & Gamble. He is labored with 3 completely different wealth managers and mentioned they supply nearly no worth in rising his web price.

Moiz is somebody who has made some huge cash and discovered, by way of first-hand expertise, how non-public wealth managers should not any higher. He has nothing to promote you.

This is what he mentioned:

A. They’ve supplied nearly no worth in rising my web price.

They promise entry to unique funding alternatives, however the investments aren’t practically nearly as good or as unique as you’d assume.

Elliott Administration has $71 Billion below administration. How unique do you assume it’s? Each wealth supervisor pitched me “unique entry†to Elliott. It is the fucking Vanguard of personal wealth managers. Forerunner Ventures? They raised $1 billion {dollars}. Nothing you could not get entry to if you happen to actually wished/tried.

However to funds you may’t get entry to, they cannot both. Sequoia? Not an opportunity in hell.

B. They’re structured towards success.

You realize what I wish to put money into? The small scrappy man who purchased two properties in SoCal or Idaho or Oklahoma and discovered find out how to work with contractors and flipped them. Now, he desires to purchase 10 or a small condo constructing and do the identical.

However Personal Wealth Managers are all targeted on buying and retaining giant, wealthy shoppers. Why? As a result of their compensation is predicated on a share of cash you might have with them. When you’ve got $10M invested with them, they make lower than when you’ve got $100M. So they need massive fish.

Consequently, they cannot put money into a man elevating $10M to purchase actual property in Coral Gables Florida, as a result of he is too small for them. They will solely put money into the Elliots of the phrase.

C. The thought that they will set you up with distinctive advisors who will probably be useful is malarkey.

The individuals they set you up with are run of the mill attorneys or accountants. They are not inventive. They are not considerate. They are not superb. In the event that they have been, they’d cling up with their very own shingle and make a ton of cash. You assume the most effective tax legal professional works at Goldman Sachs the place he makes $1m a yr? He can begin his personal agency and make 10X that.

D. They are not smarter than you.

The Personal Wealth Supervisor I work with in the present day forecasted a tender touchdown with no significant rate of interest raises 2.5 years in the past. They urged I make investments ~$10M in medium time period bonds as a result of there was 3% yield available and so they did not assume rates of interest would go up. I keep in mind sitting in that convention room listening to them and pondering “are you fucking incompetent or insaneâ€

I invested in a single fund with Colony Capital that was targeted on actual property in the course of the pandemic. It LOST cash. One of many few funds to interrupt the buck in the course of the pandemic in actual property. And it wasn’t targeted on workplace actual property, so do not even say that.

Personal Wealth Supervisor’s Ph.Ds will say “discounted money flows†and “regression evaluation†to make your head spin, after which jerk off at nighttime along with your cash.

E. The worst is Goldman Sachs although. I imply they’re the fucking worst. Reasonably than put money into Elliott, they are saying “we have now our personal Elliott the place we do the identical factor however higherâ€. Which may be true, however they’d say that it doesn’t matter what you urged. If Invoice Gates agreed to pay me a billion {dollars} tomorrow if I loaned him $1 in the present day, Goldman would advise towards it. Goldman would say “do not lend him the greenback – give it to us to take a position as an alternative†as a result of then they’d earn charges on that greenback.

Nice thread and a few attention-grabbing responses too. He ends by saying “For those who’re fascinated about utilizing a PWM [private wealth manager], I might recommend simply investing within the S&P500.â€

Once you purchase an index fund, the assorted individuals make little or no cash. The expense ratios of those index funds are extremely low (Constancy has zero expense ratio funds too). VTSAX has a 0.04%, which suggests it makes $40 for each $10,000 you make investments. You pay nothing once you purchase and also you pay nothing once you promote. Simply $40 for each $10,000 yearly.

Examine that with some other various funding. With actual property, you might have transaction prices once you purchase and promote. You might have charges on the mortgage in addition to curiosity. You might have upkeep and restore prices on the property. It is going to be far more than 0.04%. And, if accomplished correctly, actual property is usually a fantastic funding even with all these drags on return… however that is as a result of it require endurance, expertise, time and experience.

Shopping for an index fund requires none of that. However there are few individuals promoting index funds as a result of there is no cash in it!

OK, again to what common people ought to do…

1. Common Contributions

You wish to make common contributions to your brokerage accounts. This may be by way of your employer’s 401(okay) or a taxable brokerage account, however common month-to-month contributions are key.

And also you wish to contribute as a lot as you may as early as you may.

This may be 1% or 30%, you already know your price range and your wants. Your aim is to establish cash you’ll not want for 5 years and put it to give you the results you want within the markets.

In order for you a goal, make it 20%. The 20-30-50 price range is your pal.

Now, how do you allocate it?

Think about The Three Fund Portfolio

A three-fund portfolio is so easy that it looks like it should not work.

It’s a portfolio that has three funds:

- Home inventory “complete market†index fund

- Worldwide inventory “complete market†index fund

- Bond “complete market†index fund

The origin of this allocation comes from Taylor Larimore, thought of the dean of the Bogleheads (large followers of Vanguard and its founder, Jack Bogle), and defined on this discussion board submit.

It is so easy however if you happen to take a look at Vanguard’s Goal Retirement 2055 Fund, that is what it invests in (percentages as of seven/31/2024):

| Fund Title | Fund Ticker | Allocation |

|---|---|---|

| Vanguard Complete Inventory Market Index Fund Institutional Plus Shares |

VSMPX | 53.90% |

| Complete Worldwide Inventory Index Fund Investor Shares |

VGTSX | 36.10% |

| Vanguard Complete Bond Market II Index Fund Investor Shares | VTBIX | 6.90% |

| Vanguard Complete Worldwide Bond II Index Fund Institutional Shares | VTILX | 3.10% |

Vanguard’s Goal Retirement funds are easy four-fund portfolios. They change a single single bond complete market fund with a home and worldwide bond fund.

If it is adequate for the Vanguard Goal Retirement fund, it is most likely adequate for you. 😀

2. Discover Your Correct Asset Allocation

That is the “plan†a part of a monetary plan.

You realize what you wish to purchase (a easy three or 4 fund portfolio), however what are the chances?

Your asset allocation needs to be primarily based in your wants and your objectives. There are too many components to present you a easy “do that†(like we did with the three and 4 fund portfolios) however the core concept is that you might want to construct a monetary plan.

You possibly can work with an advisor or do it your self simply, as a result of the toughest half is all in your head – what are your objectives and when do you wish to accomplish them? And advisor might be useful as part-planner and part-therapist, simply having somebody to speak by way of these topics might be extraordinarily helpful.

Setting the allocation is one factor, additionally, you will wish to rebalance your portfolio on occasion. I recommend yearly, you are able to do it semi-annually, however you need your allocations to stay in the identical ratios.

3. Now Go away It Alone!

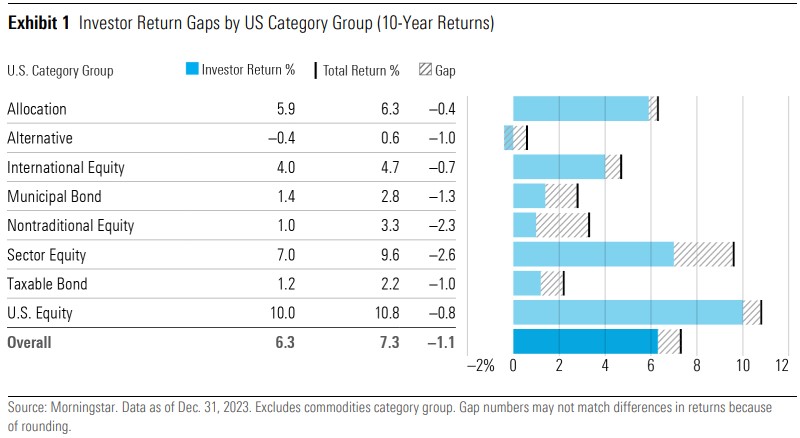

Yearly, Morningstar does a report referred to as the Thoughts the Hole report. It estimates the distinction between what traders get vs. the reported returns of their investments.

Within the chart above, the blue bar is what traders bought, the black line reveals the full return of the asset class, and the grey slashes reveals the hole.

Every year, they estimate that there’s a few 1% hole. For 2024, the hole was 1.1%. It was largest within the extra risky funding classes.

Over the course of 30 years, 1% distinction can imply lots of of 1000’s of {dollars}.

However why are traders returns lagging precise funding returns? It is due to market timing – when the investor buys and sells the belongings. And traders as an entire are shedding (if we have been good at market timing, returns could be better than the asset’s complete return).

Don’t attempt to market time – simply make these common contributions and go away it alone. It’s extremely arduous, it is why individuals name this the “boring center†but it surely’s completely important you keep away from messing along with your investments.

Investing would not need to be difficult but it surely’s arduous (no less than for me!) to be affected person.